Country comparisons and factors contributing to their relative advantage or disadvantage in a global market.

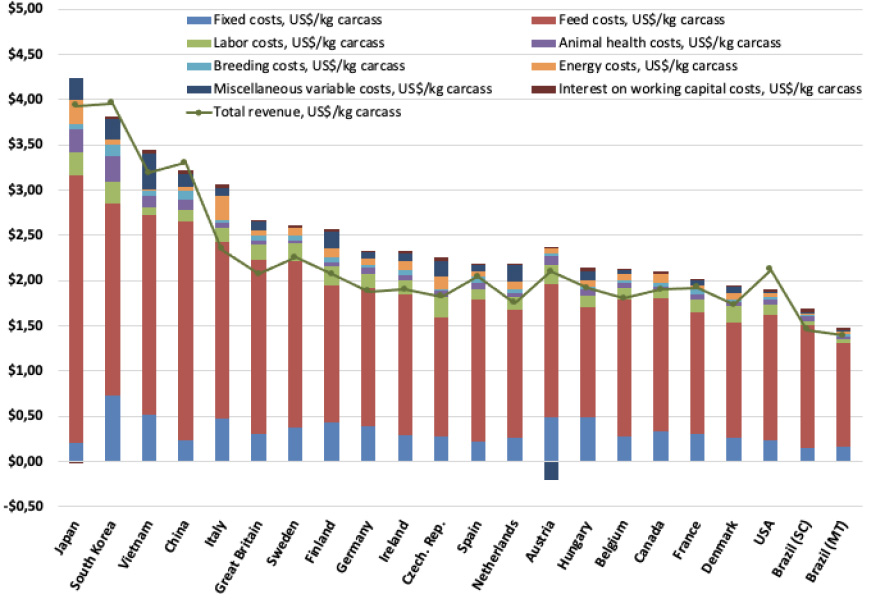

Production costs

- Japan and South Korea had the highest production costs per kg of pork sold.

- Brazil was the world’s low-cost supplier.

Feed prices

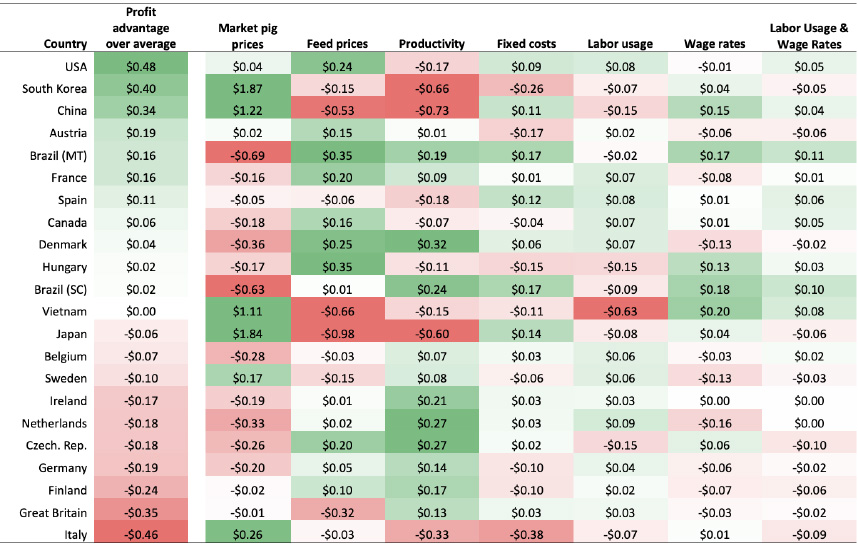

- Producers in Japan had the highest feed prices, which placed them at a US$0.98 per kg of carcass weight disadvantage*.

*Over a country with average feed prices.

Pig prices

- High market pig prices in South Korea and Japan gave producers there a respective US$1.87 and US$1.84 per kg of carcass weight advantage.

*Over a country with average market pig prices.

Productivity

- Denmark, the Netherlands, and the Czech Republic ranked at the top on animal husbandry and productivity.

Overall profit

- All countries experienced negative profits except South Korea, China and the USA.

- The USA had an overall US$0.48 profit advantage per kg of carcass weight over the world average.

Stay tuned for the swine benchmarking 2023!

Coming soon

How do producers in each country stack up regarding the profitability and cost of producing pork, and what factors contribute to their relative advantage or disadvantage in a global market?

Figure 1. Cost of production and revenue for each country (US$ per kg of carcass weight), breed-to-market. 2022.

The factors that contributed to the highest relative advantage or disadvantage in profitability for producers in each country were market pig prices, feed prices, and productivity.

Table 1. Profit advantage of select factors, all other variables held constant, US$ per carcass kg sold basis, 2022.

Conclusions

- If we compare pork producers based on profitability, as we do when we evaluate companies, the USA and South Korea come out on top in 2022.

- If we use animal husbandry and productivity as a performance measure, then Denmark, the Netherlands, and the Czech Republic rank at the top.

- If we use production costs as a metric, Brazil is the most competitive.